Almost every month we receive a lot of bills, bank statements, information on our financial investments in our mail. Some of these documents get stuffed in a drawer or get tossed in a tray kept on the refrigerator, where they keep lying for ages. Sometimes they are opened and read or just cursorily scanned and sometimes, they lie unopened and are totally neglected. Some of these documents do find a place in a box file, while some are simply tossed away in the trash.

And when there is a need to know details of any financial record/investment, the whole house is turned into a treasure hunt. Ok, that’s a bit of an exaggeration , but you get the picture of the inability to find information when it’s needed the most!

Recently, I came across My Money Book from Exide Life Insurance.

It is a record book specifically designed to help create a consolidated and comprehensive record of all financial engagements. I quite loved this small little book. You may like to know the reasons. So here I go…

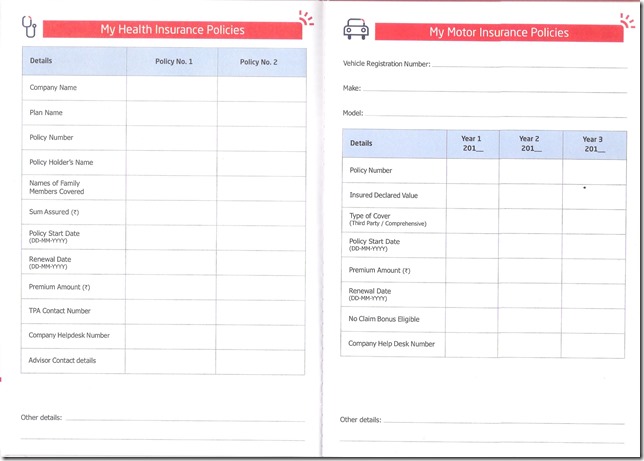

- One-Stop-Organizer. At one place, we can have records of all the financial documents / investments. In My Money Book, we can not only document details of our own financial engagements but that of the whole family too. In this book, we can record the following details:

INSURANCE POLICIES

|

BANK DETAILS

|

LOANS

|

INVESTMENTS

|

- Records at a Glance : My Money Book gives a quick and a comprehensive summary of all the financial records.

- Simple and Easy : It is based on the age old principle of documentation. Yes, all we have do is fill in the information of all the financial engagements which is just a one time activity, but it can help us to stay organized and make life easier for a lifetime.

- Saviour for the Family : In the event of an emergency or an unforeseen turn of events, the details of all the financial records can help the family members to track/manage the same easily. I remember, an acquaintance was not aware of any financial investments done by her late husband. As a result, it took a long time to gather all the info and act on them and probably some investments stayed undiscovered and unacted on too!

- Review of All Investments : Since, all the financial investments are all at one place in My Money Book, it makes it easier to review all the current investments. Based on this info, we can set and act on some more financial goals for self and the family.

While, the current edition of My Money Book is pretty good, but I wouldn’t mind the ebook format of it too. And also if, the internet banking details viz customer id and other log-in details could be added in the Bank Details. A few blank sheets for jotting down extra details would be welcome too.

Being unorganized is a sure shot recipe for messing up the financial engagements. My Money Book from Exide Life Insurance helps us to stay organized for a long and happy journey called life!

This review is a part of the biggest Book review program for Indian Bloggers.Participate now to get free books!

The more consistent folks are with their record-keeping, the better for their finances. Sounds like this book is a great help, Shilpa!

This is a printed book, you mean?

This book seems like a great idea to consolidate all the financial information: keeping it organized all in one place makes perfect sense! 🙂 <3